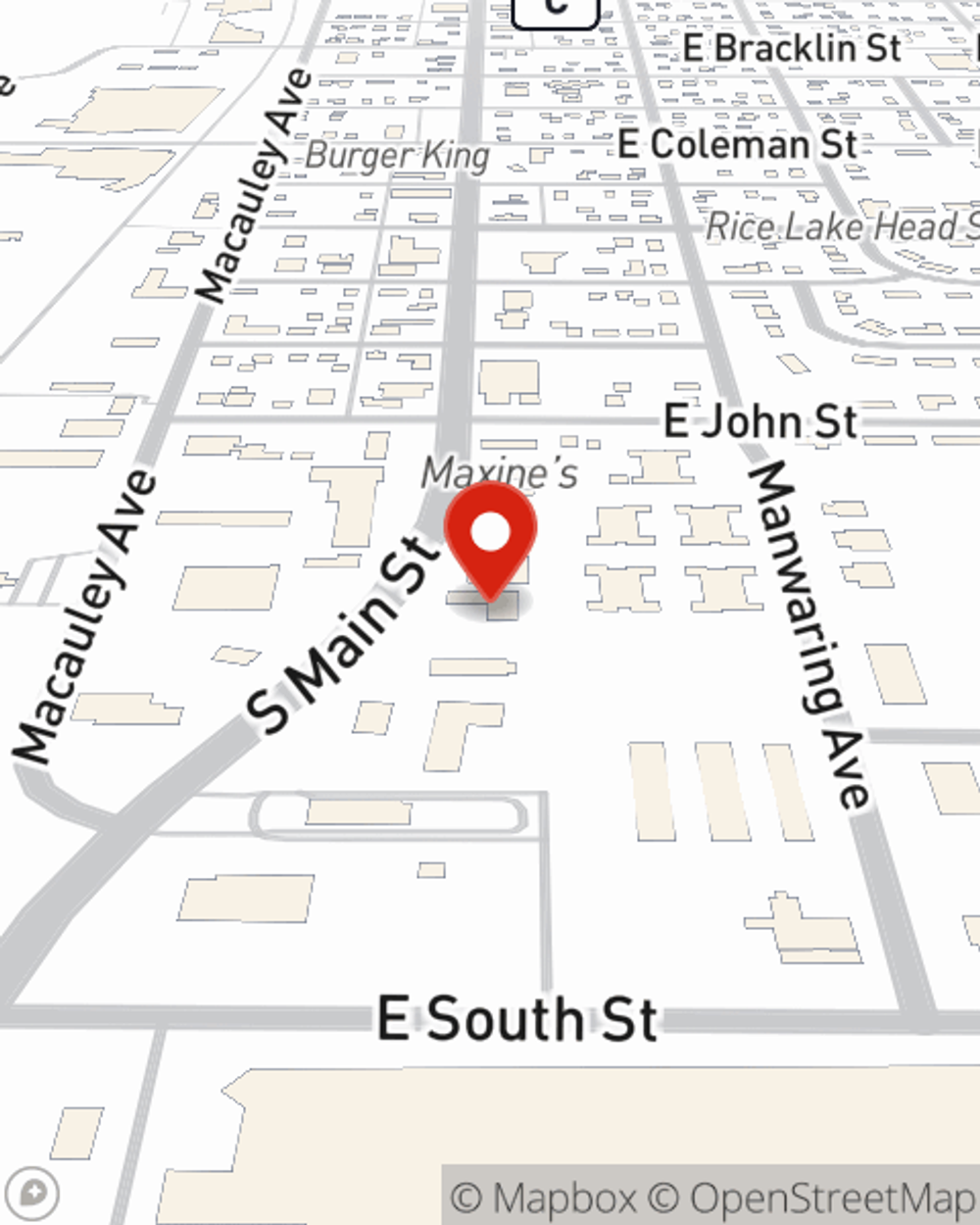

Insurance in and around Rice Lake

Need insurance? We got you.

Protect what matters most

Would you like to create a personalized quote?

Tried And True Insurance Customizable To Fit You

We can help you create a Personal Price Plan® to help protect what’s important to you – family, things and your bottom line. From safe driving rewards, bundling options and discounts*, create your coverage to meet your unique needs. Contact Ashley Headley for a Personalized Price Plan.

Need insurance? We got you.

Protect what matters most

Our Broad Range Of Insurance Options Are Outstanding

But your vehicle is just one of the many insurance products where State Farm and Ashley Headley can help. Do you operate a business in the Rice Lake area or want to be your own boss? Navigating the complicated world of small business insurance? Ashley Headley can make it easy to find the insurance you need to protect what you’ve worked so hard to achieve. And we also offer a number of liability insurance options to guard the ones you love in the event of an illness or injury.

Simple Insights®

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Ashley Headley

State Farm® Insurance AgentSimple Insights®

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.